44 consider a bond paying a coupon rate of 10 per year semiannually when the market

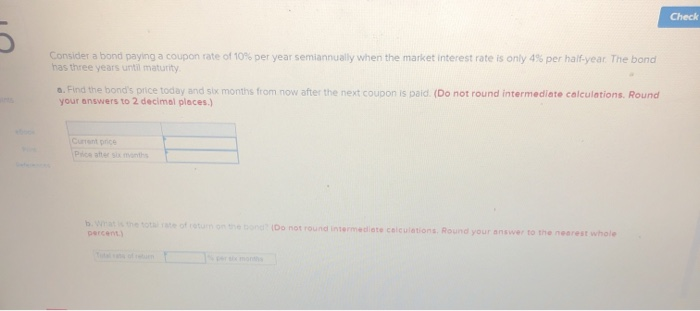

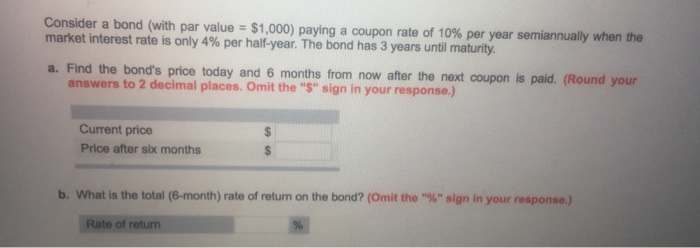

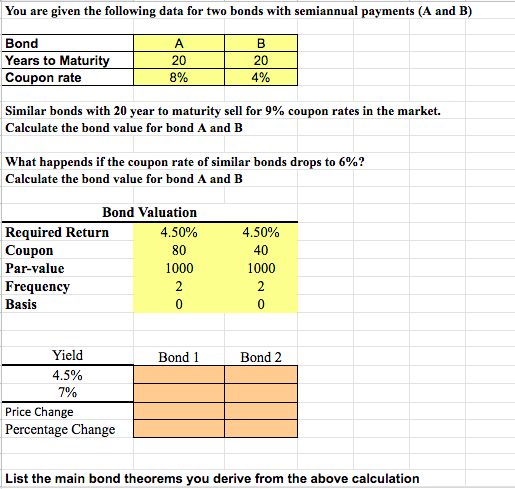

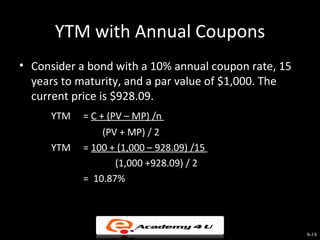

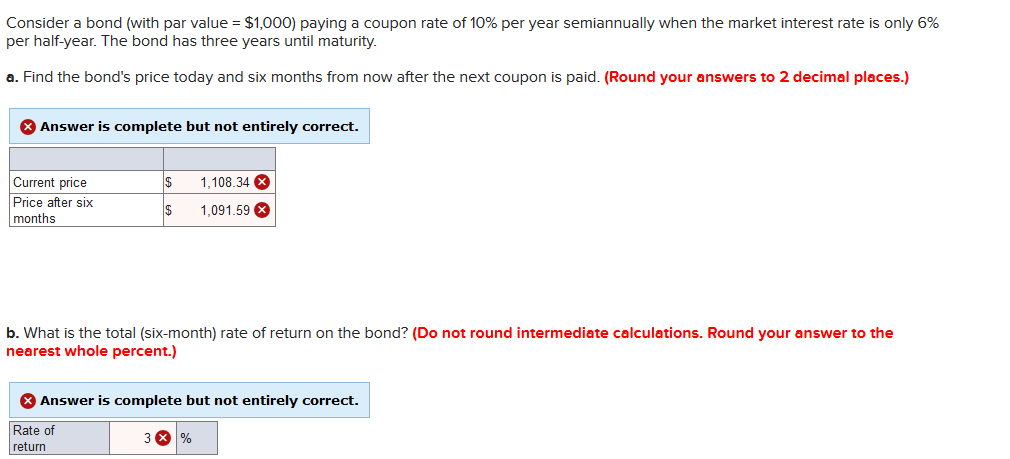

FIL 242 Exam 2 Flashcards | Quizlet XYZ Corporation has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last for another 2 years after which the firm's growth rate would drop to a constant, perpetual growth rate of 6%. The most recent dividend that was just paid was $1.60 per share, and the required rate of return is 10%. Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? BusinessFinance Answer Step #1 of 3 a)

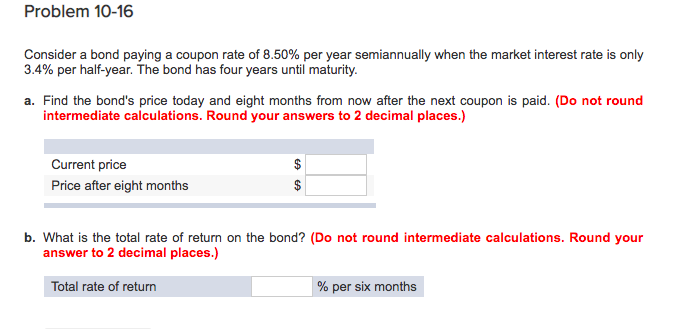

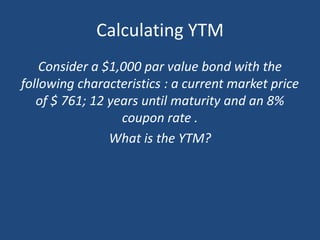

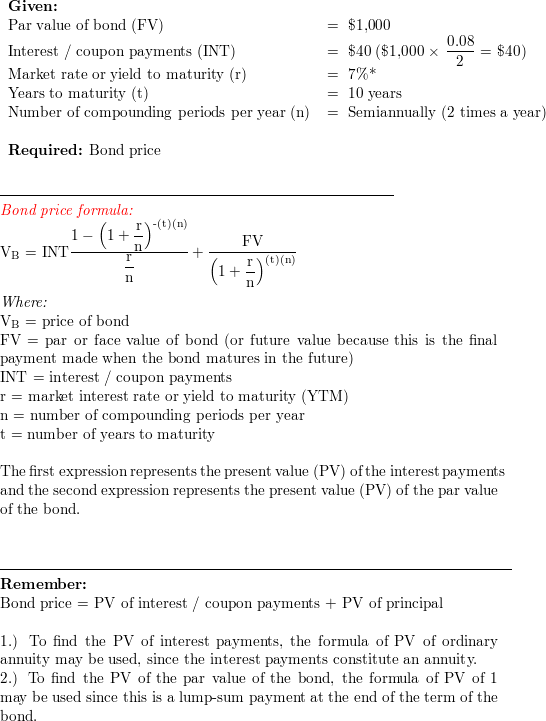

Consider a bond (with par value = $1,000) paying a coupon rate of 8% ... Explanation: Face Value = $1,000 Annual Coupon Rate = 8% Semi-annual Coupon Rate = 4% Semi-annual Coupon = 4%*$1,000 = $40 Semi-annual YTM = 6% Today: Time to Maturity = 3 years Price = $40*PVIFA (6%, 6) + $1,000*PVIF (4%, 6) Price = $40* (1- (1/1.06)^6)/0.06 + 1,000/1.06^6 Price = 901,65 Six months from now: Time to Maturity = 2.5 years

Consider a bond paying a coupon rate of 10 per year semiannually when the market

Solved Consider a bond (with par value = $1,000) paying a | Chegg.com See the answer Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 3% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. (Round your answers to 2 decimal places. SEC.gov | HOME Verkko16.11.2020 · New York City time on the Reuters Page ICESWAP1 on any day on which the such rate must be determined, such rate for such day will be determined on the basis of the mid-market semi-annual swap rate quotations to the calculation agent provided by five leading swap dealers in the New York City interbank market selected by the … achieverpapers.comAchiever Papers - We help students improve their academic ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

Consider a bond paying a coupon rate of 10 per year semiannually when the market. › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. 8 consider a bond paying a coupon rate of 10 per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has 3 years until maturity. a) Find the bond's price today and 6 months from now after the next coupon is paid b) What is the total (6-month) rate of the return on the bond? 9. Top answer: Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually… Image transcription textConsider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%per half-year. The bond has three years until maturity… Show more Business This question was created fromweek2.xlsx › how-do-bond-etfs-workHow Do Bond ETFs Work? | ETF.com Nov 18, 2022 · A hypothetical $100 bond has a 5 percent coupon — meaning, every year, the bond will pay out $5 to investors until it matures. Then interest rates rise 2 percent. Then interest rates rise 2 percent.

Solved > Question Consider a bond paying a coupon rate:457076 ... Question. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Code of Laws - Title 44 - Chapter 7 - Hospitals, Tuberculosis … VerkkoSECTION 44-7-910. Authority to establish and maintain hospital. Any city or town in this State having a population of not less than one thousand inhabitants and not more than five thousand, according to the 1940 census of the United States, may establish, construct, operate and maintain a municipal hospital, either within or without its … Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid. Solutions Verified Solution A Solution B Create an account to view solutions Join LiveJournal VerkkoPassword requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Internal Revenue Bulletin: 2004-33 | Internal Revenue Service Verkko16.8.2004 · Like-kind exchanges using qualified exchange accommodation arrangements. This procedure modifies Rev. Proc. 2000-37, 2000-2 C.B. 308, to provide that the safe harbor of Rev. Proc. 2000-37 does not apply to replacement property held in a qualified exchange accommodation arrangement if the property is owned by a taxpayer within … Solved Consider a bond paying a coupon rate of 10% per - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6 month) rate of return on the bond? Expert Answer › Archives › edgarSEC.gov | HOME Nov 16, 2020 · An interest rate swap rate, at any given time, generally indicates the fixed rate of interest (paid semi-annually) that a counterparty in the swaps market would have to pay for a given maturity, in order to receive a floating rate (paid quarterly) equal to 3-month USD LIBOR, or another index rate, for that same maturity. Consider a bond paying a coupon rate of 10% per year semiannually when ... Using a financial calculator , you can solve for bond price with the following inputs; Maturity of bond (as of today); N = 3*2 = 6 Face value ; FV = 1000 Semiannual coupon payment; PMT = (10%/2 )*1000 = 50 Semiannual interest rate; I/Y = 4%/2 = 2% then CPT PV = $1,168.04 6-months from today, you will use the following inputs to find new price;

Interest - Wikipedia VerkkoCompound interest includes interest earned on the interest that was previously accumulated. Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year.The total interest payment is $6 per $100 par value in both …

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? This problem has been solved!

Pro Rata: What It Means and the Formula to Calculate It Verkko18.7.2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

Solved Consider a bond paying a coupon rate of 10.50% per - Chegg Question: Consider a bond paying a coupon rate of 10.50% per year semiannually when the market interest rate is only 4.2% per half-year. The bond has two years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

BKMPR Chapter 12 Posted Solutions | PDF | Bonds (Finance ... - Scribd The real rate of return in each year is precisely the 4% real yield on the bond. 12-2. A newly issued bond pays its coupons once annually. Its coupon rate is 5%, its maturity is 20 years, and its yield to maturity is 8%. Find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 7% by the ...

Achiever Papers - We help students improve their academic standing VerkkoWith course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid. b) What is the total rate of return on the bond? Dec 28 2021 | 05:26 PM | Solved

Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is t

Solved Consider a bond paying a coupon rate of 10% per - Chegg See the answer Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expert Answer

[Solved] Consider a bond paying a coupon rate of 1 | SolutionInn Consider a bond paying a coupon rate of 10% per. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b.

Yield to Maturity and Default Risk - Rate Return - Do Financial Blog Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. ... Consider a five-year bond with a 10% coupon that has a present yield to maturity of 8%. If ...

Consider a bond (with par value = $1,000) paying a coupon rate of 10% ... Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 7% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

P0. Background_Review_Questions_with_solutions.pdf Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond over that six months? 2.

Publication 550 (2021), Investment Income and Expenses VerkkoYou bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero.

› terms › pPro Rata: What It Means and the Formula to Calculate It Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

Foundations of Finance - Class 8 and 9 - Quizlet Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? ... 16.

OneClass: Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b.

› learn › storyBonds vs. Bond Funds: Which is Right for You? | Charles Schwab Jan 24, 2020 · Since bond mutual funds and ETFs own many securities, the impact of one bond default would likely be less than for an individual investor owning individual bonds. While some bond investments may be made in denominations as low as $1,000 per bond, the appropriate amount to invest is best determined by an individual's investing goals and objectives.

Assignment Essays - Best Custom Writing Services Verkko$10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. Do My Paper. Essay Help for Your Convenience. ... We offer the lowest prices per page in the industry, with an average of $7 per page. Assignment Essays Features. Get All The Features For Free. $11. per page. FREE Plagiarism report.

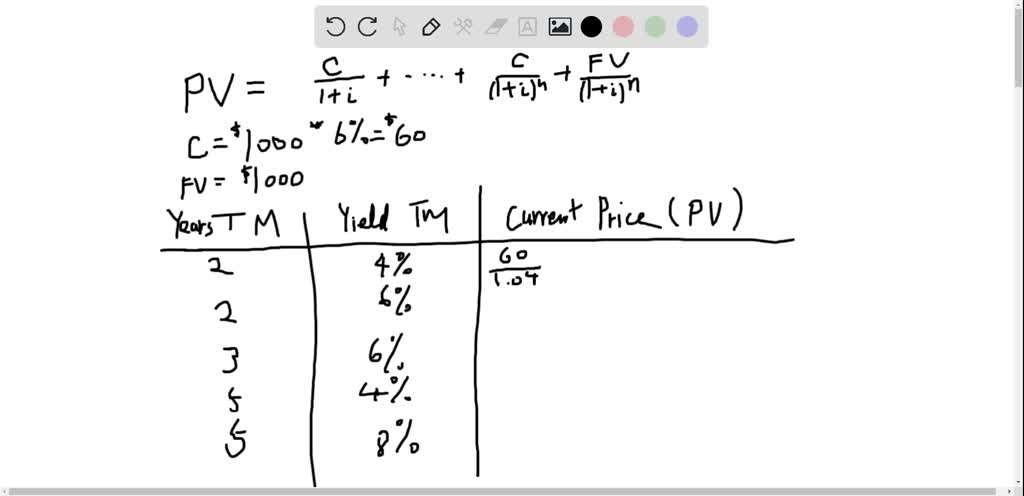

Consider a bond with a 6 % annual coupon and a face value of 1,000 . Complete the following table. What relationships do you observe between years to maturity, yield to maturity, and the current ...

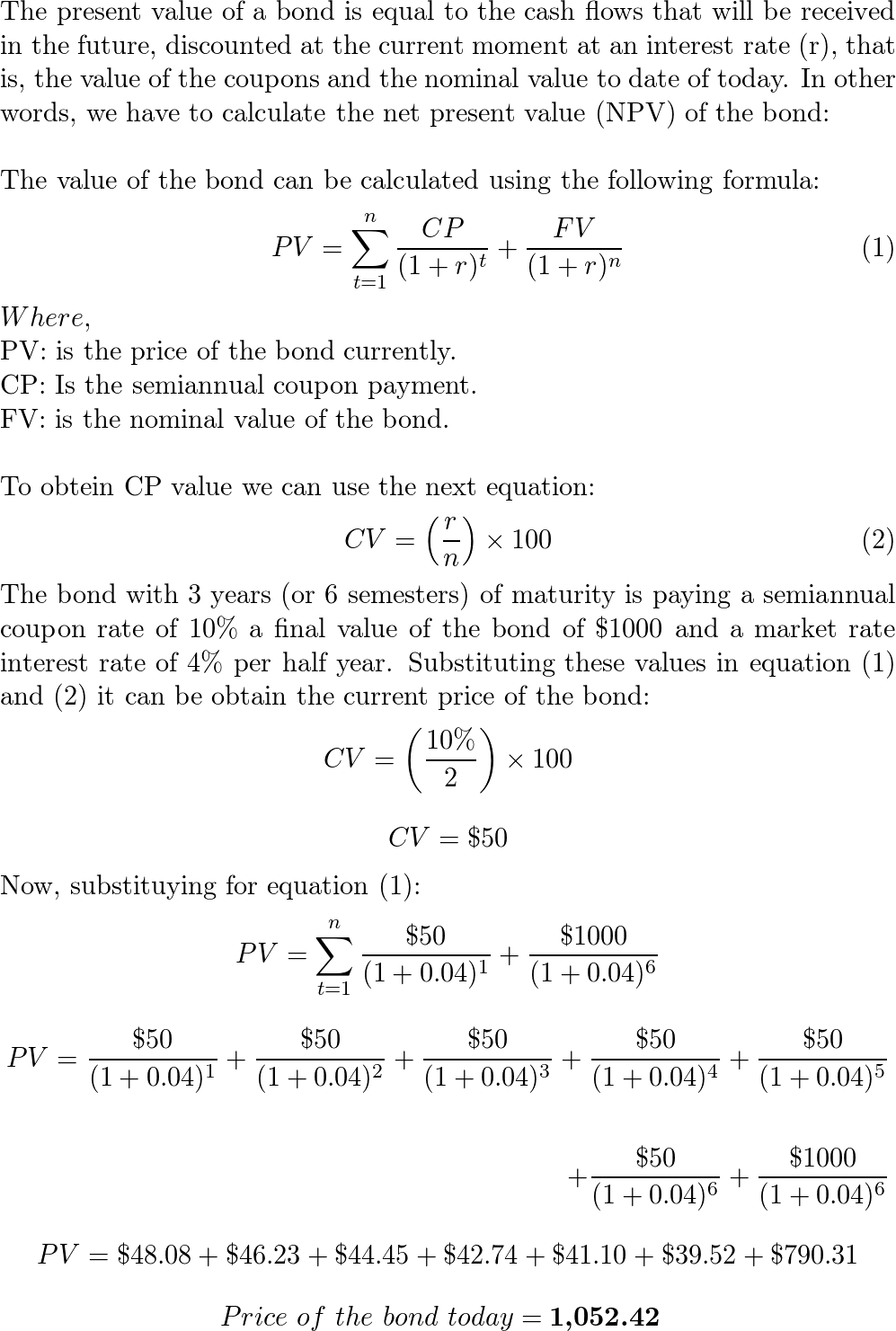

Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year.

Consider a bond paying a coupon rate of 10% per year...open 5 Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per half a year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Jun 29 2021 | 10:57 AM | Solved

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba Consider a bond paying a coupon rate of 10% per year...get 5 Questions & Answers Accounting Financial Accounting Cost Management Managerial Accounting Advanced Accounting Auditing Accounting - Others Accounting Concepts and Principles Taxation Accounting Information System Accounting Equation Financial Analysis

Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond

Consider a bond paying a coupon rate of $10\%$ per year semi | Quizlet Question Consider a bond paying a coupon rate of 10\% 10% per year semiannually when the market interest rate is only 4\% 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? Solution Verified

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Verkko19.4.2021 · The bond pays interest of ($1,000,000 multiplied by 6%), or $60,000 per year. Since the bond pays interest semiannually, ... Assume that a bond has a face value of $1,000 and a coupon rate of 6%. ... if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%.

assignmentessays.comAssignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ...

Consider a bond paying a coupon rate of 9.25% per year semiannually ... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate is only 3.7% per half-year. The bond has five years until maturity a. Find the bond's price today and six months from now alter the next coupon is ...

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

achieverpapers.comAchiever Papers - We help students improve their academic ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

SEC.gov | HOME Verkko16.11.2020 · New York City time on the Reuters Page ICESWAP1 on any day on which the such rate must be determined, such rate for such day will be determined on the basis of the mid-market semi-annual swap rate quotations to the calculation agent provided by five leading swap dealers in the New York City interbank market selected by the …

Solved Consider a bond (with par value = $1,000) paying a | Chegg.com See the answer Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 3% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. (Round your answers to 2 decimal places.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "44 consider a bond paying a coupon rate of 10 per year semiannually when the market"