43 zero coupon bond accrued interest

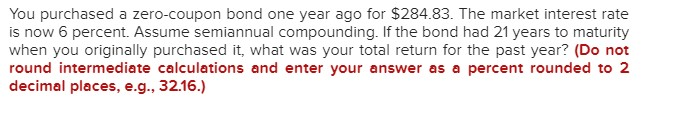

Zero Coupon Bonds | Alamo Capital Buy Zero Coupon Bonds. If you are interested in buying zero coupon bonds, contact Alamo Capital by phone at (877) 682-5266 - or - (877) 68-ALAMO, by email at information@alamocapital.com, or by filling out the form below. Our experienced zero coupon bond specialists can provide you with information about the current inventory of zero coupon ... Zero Coupon Bonds - CMT Association Zero Coupon Bonds. These bonds are sold at a deep discount from the value of the bond at maturity. They pay no current interest rate. U.S. savings bonds are issued in a like manner. There are tax obligations due on those bonds for accrued interest and they must be paid. Sometimes Treasury bonds are stripped of their coupons and sold as zero ...

Zero-Coupon Bond - Fincyclopedia A bond that accrues interest over its life. Accrued interest is only payable at the maturity date of the bond. More specifically, a zero coupon bond (or simply, zero) doesn't pay interest during its life, but rather it is typically sold to investors at a deep discount from its face value (i.e., the amount a bond will be worth at its maturity or due date).

Zero coupon bond accrued interest

How to Buy Zero Coupon Bonds | Finance - Zacks 1. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Zero coupon bond accrued interest. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. Understanding Zero Coupon Bonds - Part One - The Balance The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value. Some issuers may call zeros before maturity. You must pay tax on interest annually even ... Accrued Interest | What It Is and How It's Calculated So, the formula to calculate accrued interest is: Face Value x (Coupon Rate ÷ 365) x Accrual Period That means an investor who sells a $100,000 bond with a 4 percent coupon 63 days after the bond's last payment date would receive $690.41 in accrued interest from the bond's buyer. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for... Bond Pricing and Accrued Interest, Illustrated with Examples Steps to Calculate the Price of a Zero Coupon Bond Total Interest Paid by Zero Coupon Bond = Face Value - Discounted Issue Price 1 Day Interest = Total Interest / Number of Days in Bond's Term Accrued Interest = (Settlement Date - Issue Date) in Days × 1 Day Interest Zero Coupon Bond Price = Discounted Issue Price + Accrued Interest 1 Calculation of accrued interest – General considerations What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon...

Investor's Guide to Zero-Coupon Municipal Bonds - Project Invested An estimated $11.1 billion in municipal bonds are traded daily in the secondary market. Yield (or Current yield). The annual percentage rate of return earned on a bond calculated by dividing the coupon interest rate by its purchase (market) price. Zero-coupon bond. A bond for which no periodic interest payments are made. Zero coupon municipal bonds maturation - Intuit The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond. That means you have to calculate the portion of the difference between the purchase price and face value that accrued to you. $500 x 0.0705 = $35.25 ... Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period. Imputed Interest - Overview, Calculation, Tax Implications In filing tax returns, zero-coupon bonds are required to declare the imputed interest. The imputed interest for the year on zero-coupon bonds is estimated as the accrued interest rather than the minimum interest like in below-market loans. It is calculated as the yield to maturity (YTM) multiplied by the present value of the bond. The value of ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the face value and price of the bond could be thought of as the interest earned.

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet Using the earlier example, if you paid $500 for a 10-year, $1,000 bond getting an interest rate of 7.05%, you would accrue $35.25 of interest in the first year. $500 x 0.0705 = $35.25. Your ...

Zero-Coupon Bonds - REC Wealth Management For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Accrued Interest - Bond Dirty Price vs. Clean Price It is the bond's accrued interest. Exhibit 2: A bond's market value (dirty price) can be disaggregated into a clean price and accrued interest. If we add the two graphs of Exhibit 2 together, we get the graph of Exhibit 1. We called the quantity depicted in Exhibit 1 the bond's market value, but another name for it is the bond's dirty price.

Value and Yield of a Zero-Coupon Bond | Formula & Example A zero-coupon bond has higher interest rate risk than a traditional bond. ... (1 + 6.8%) 9: Expected accrued income = Value at the end of a period − Value at the start of a period = $5,317. This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results ...

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Advantages and Risks of Zero Coupon Treasury Bonds If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local...

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

How to Buy Zero Coupon Bonds | Finance - Zacks 1. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at...

/CoupleDiscussingFinances-b8a973ead5384d31af51e8e65ec595ed.jpg)

Post a Comment for "43 zero coupon bond accrued interest"