39 coupon rate calculator for bonds

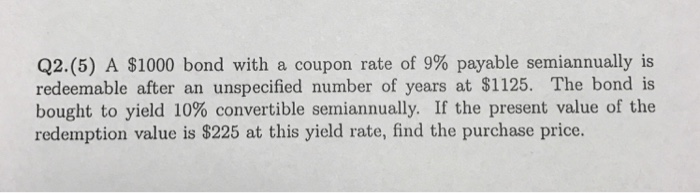

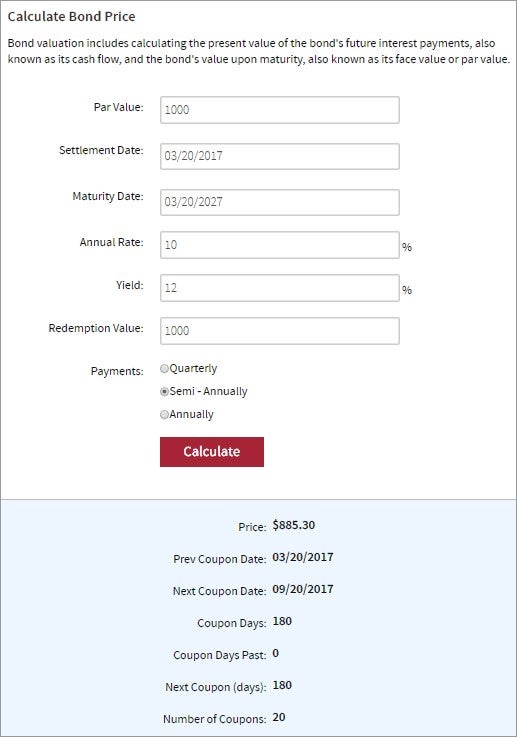

Bond Valuation Calculator | Calculate Bond Valuation Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the ... › terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio

Coupon rate calculator for bonds

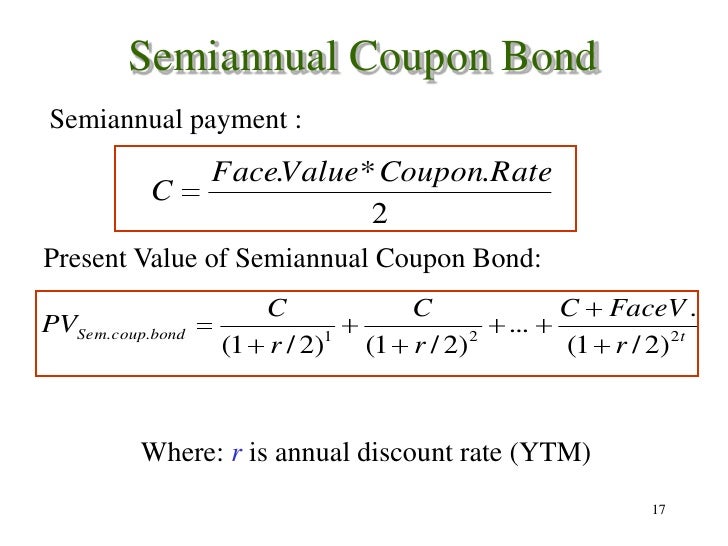

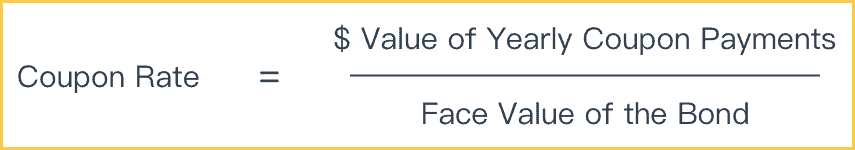

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Still, the term persists. The coupon is expressed as a percentage of the bond's face value. So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate ... How do you calculate the interest rate of a bond? For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. How do you calculate annual interest on a bond? Multiply the bond's face value by the coupon interest rate. For example, if the bond's face value is $1000, and the interest rate is 5%, by multiplying 5% by $1000, you can find out ...

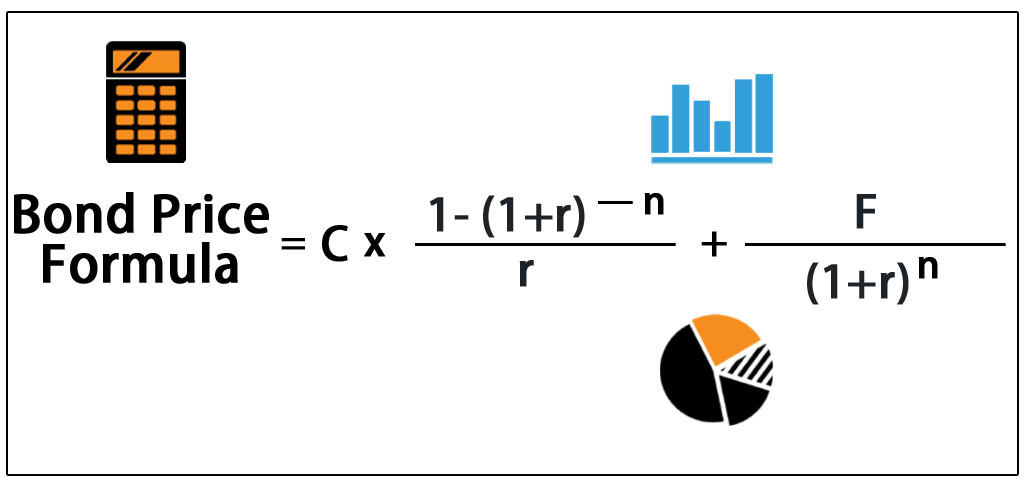

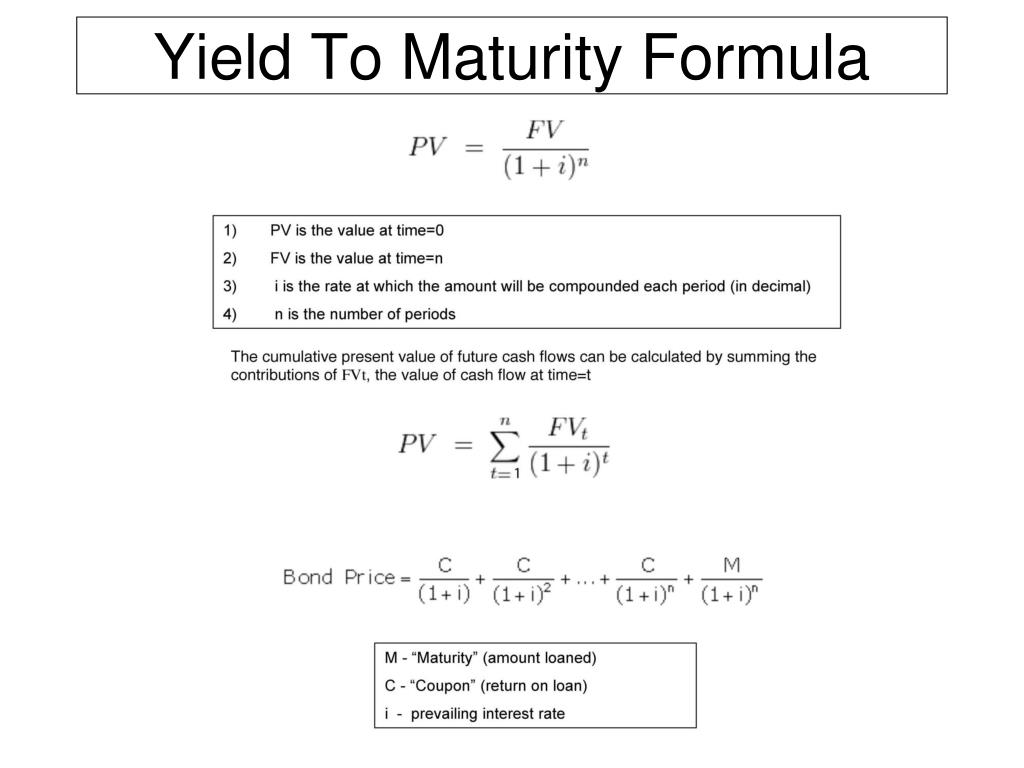

Coupon rate calculator for bonds. Compound Interest Calculator - Moneychimp See How Finance Works for the compound interest formula, (or the advanced formula with annual additions), as well as a calculator for periodic and continuous compounding. If you'd like to know how to estimate compound interest, see the article on … Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. How to Calculate Coupon Rate in Excel (3 Ideal Examples) In this article, we will learn to calculate the coupon rate in Excel.In Microsoft Excel, we can use a basic formula to determine the coupon rate easily.Today, we will discuss 3 ideal examples to explain the coupon rate.Also, we will demonstrate the process to find the coupon bond price in Excel. So, without further delay, let's start the discussion.

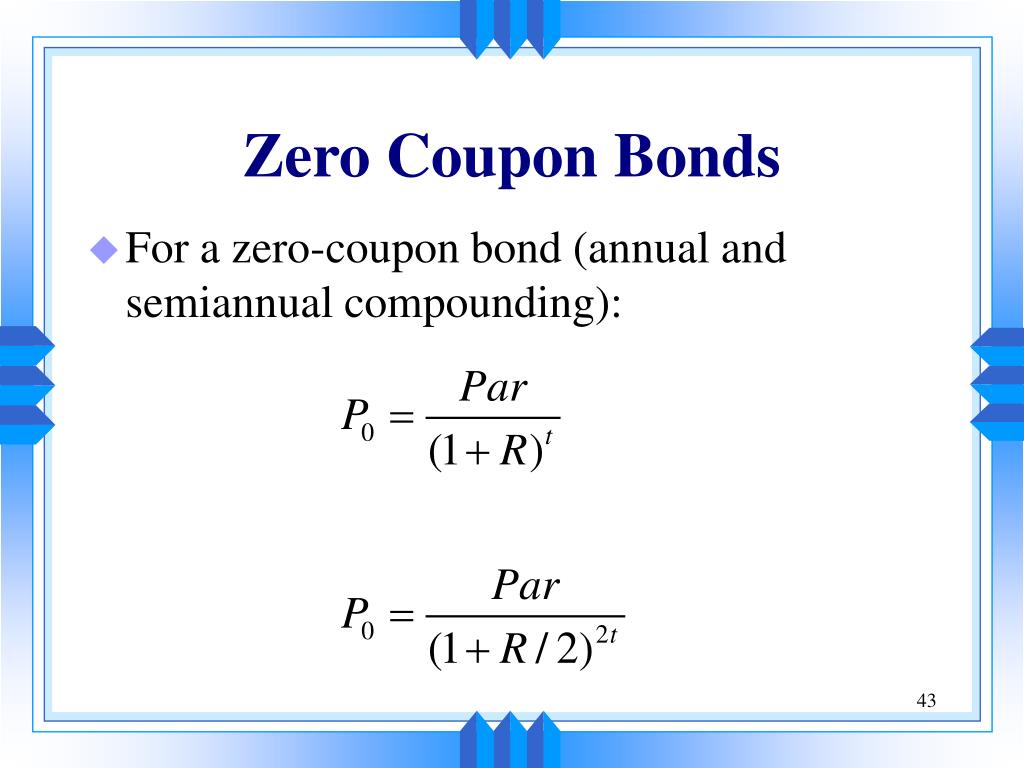

moneychimp.com › calculator › compound_interest_calculatorCompound Interest Calculator - Moneychimp Compound interest - meaning that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate - is one of the most useful concepts in finance. It is the basis of everything from a personal savings plan to the long term growth of the stock market. CD Calculator Zero-Coupon CD—Similar to zero-coupon bonds, these CDs contain no interest payments. Rather, they are reinvested in order to earn more interest. Zero-coupon CDs are bought at fractions of their par values (face value, or amount received at maturity), and generally have longer terms compared to traditional CDs, which can expose investors to considerable risk. Financial Calculators The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds. Bond Price Field - The Price of the bond is calculated or entered in this field. Enter amount in negative value. Bond Yield to Maturity (YTM) Calculator - DQYDJ The calculator internally uses the secant method to converge upon a solution, and uses an adaptation of a method from Github user ndongo. Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes ...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular ... Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments. Bond Yield Calculator - Compute the Current Yield - DQYDJ On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula. Coupon Rate Calculator | Bond Coupon 12.01.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you …

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Coupon Rate Definition - Investopedia 05.09.2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Bond Price Calculator - Brandon Renfro, Ph.D. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon payments.

Bond Yield Calculator Current bond yield = Annual interest payment / Bond's current clean price; Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it should be multiplied with 0.01 to convert it from percent. What is bond yield?

What Is a Coupon Rate? How To Calculate Them & What They're Used For Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. …

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Bonds: These have maturities beyond 10 years & pay interest semi-annually. Longer duration bonds are more sensitive to shifts in interest rates. And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest.

Bond Yield Calculator - CalculateStuff.com In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond Price = current price of the bond. Face Value = amount paid to the bondholder at maturity. Coupon = periodic coupon payment.

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Compare Fixed Rate Bonds | MoneySuperMarket Fixed term bonds generally have minimum and maximum opening deposits. Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable). You may find the ...

Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par value and each coupon payment.

Bond Calculator | Calculates Price or Yield Calculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

Post a Comment for "39 coupon rate calculator for bonds"