38 coupon rate vs ytm

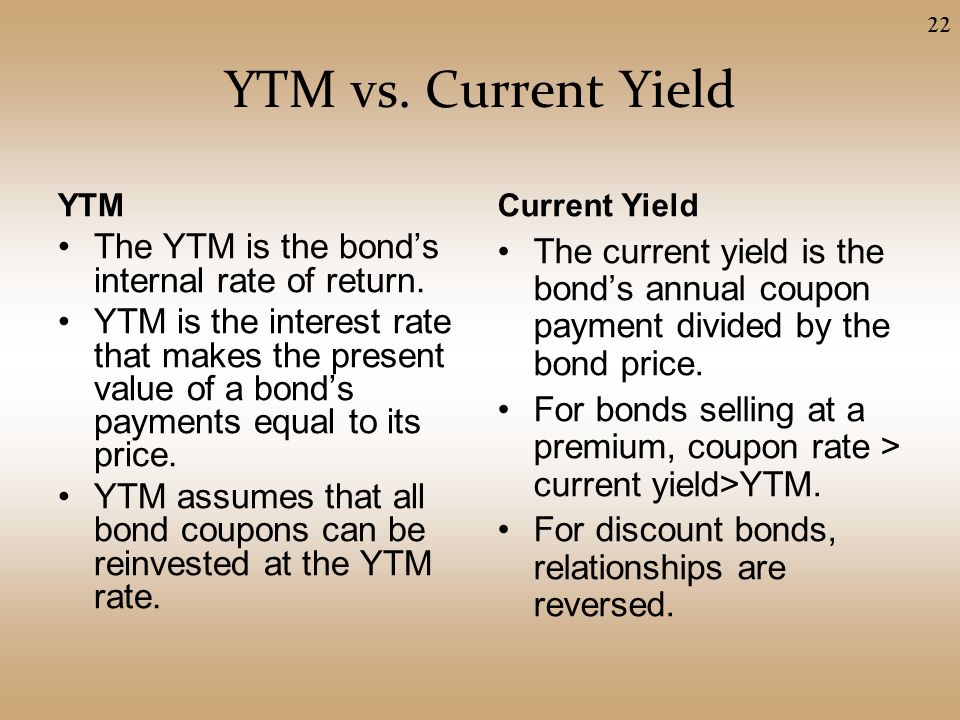

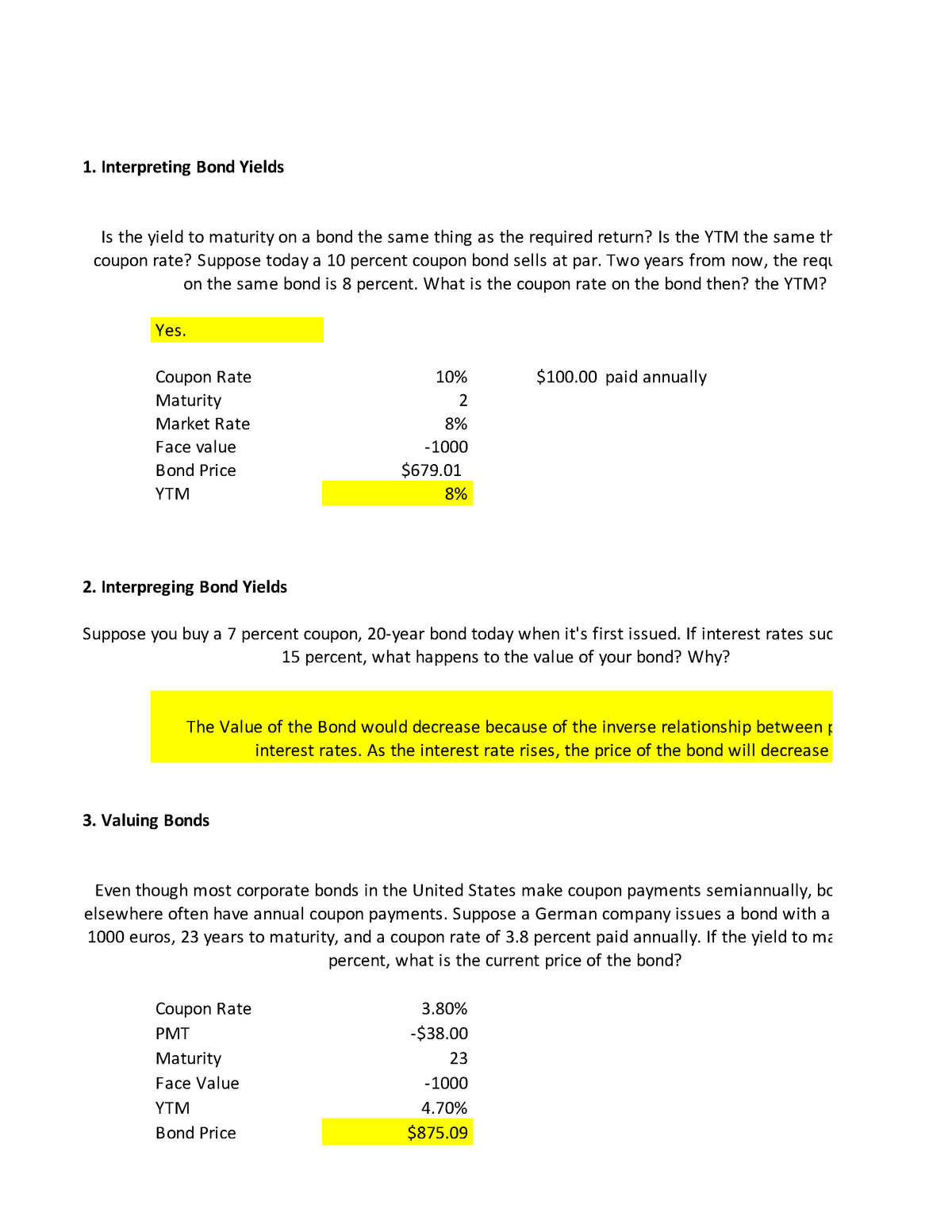

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples... Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

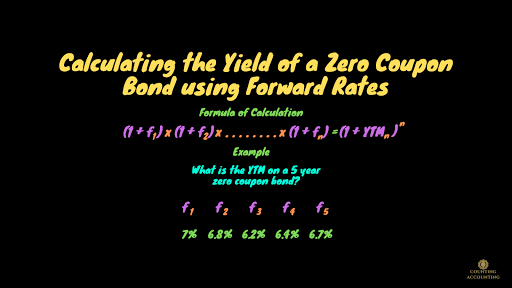

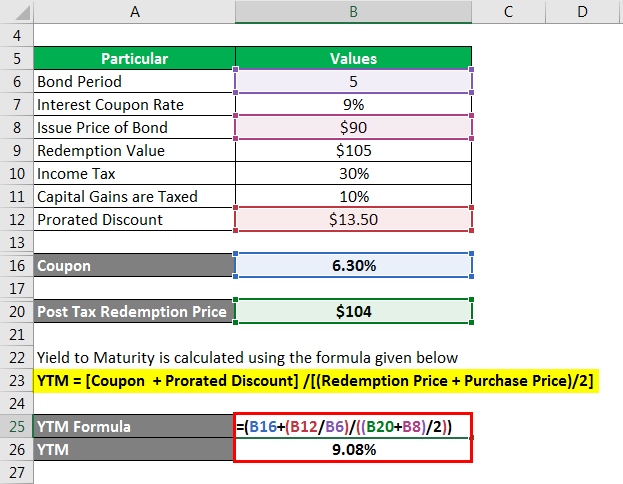

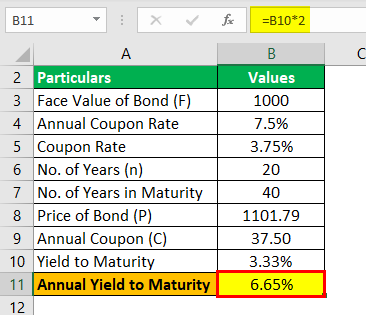

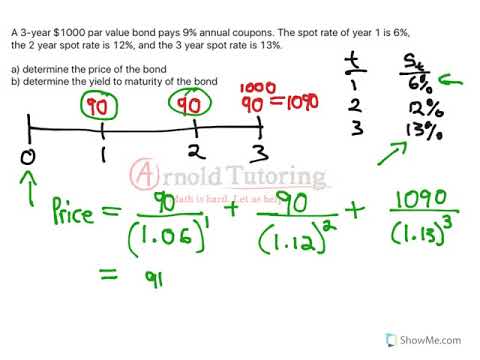

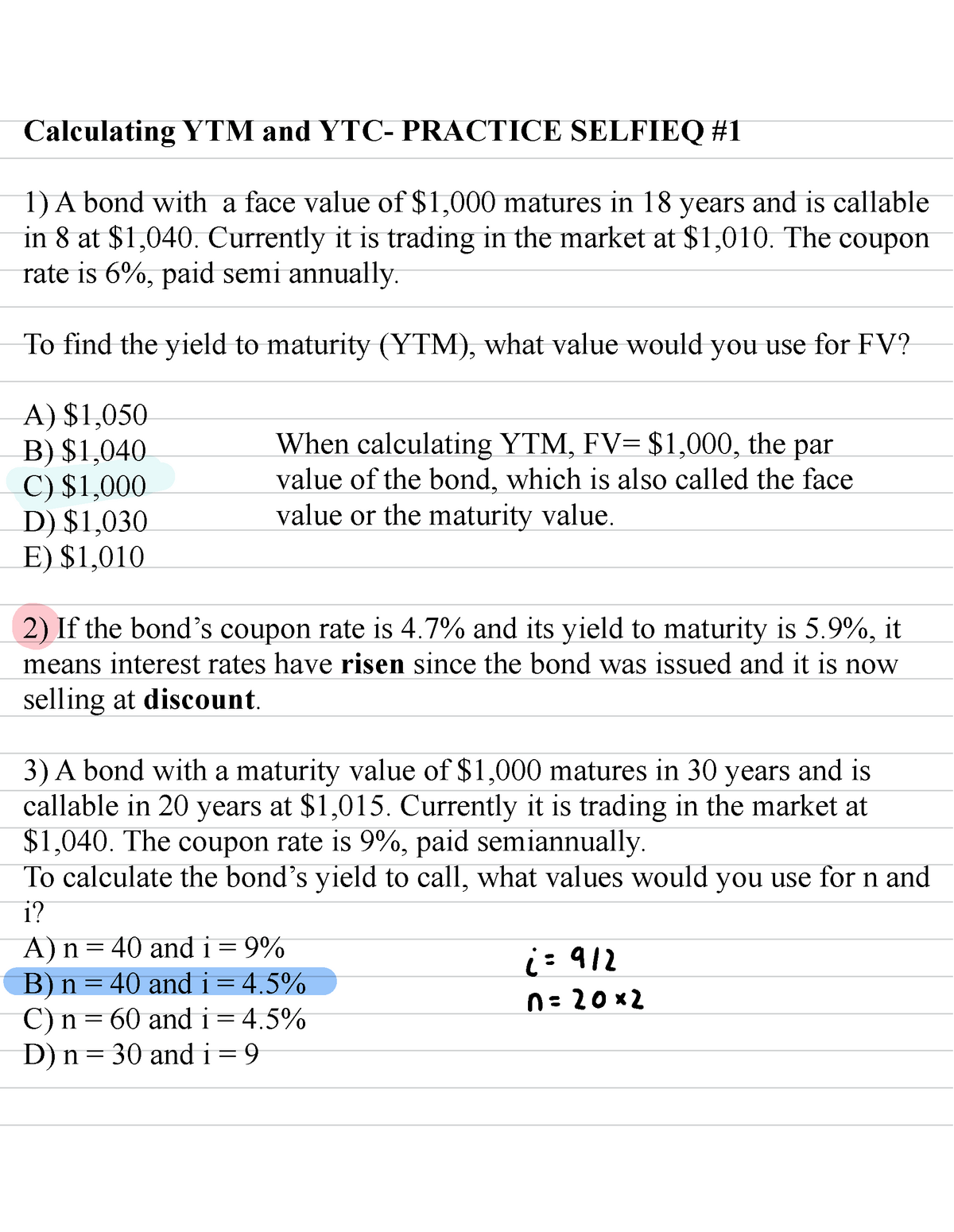

Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ...

Coupon rate vs ytm

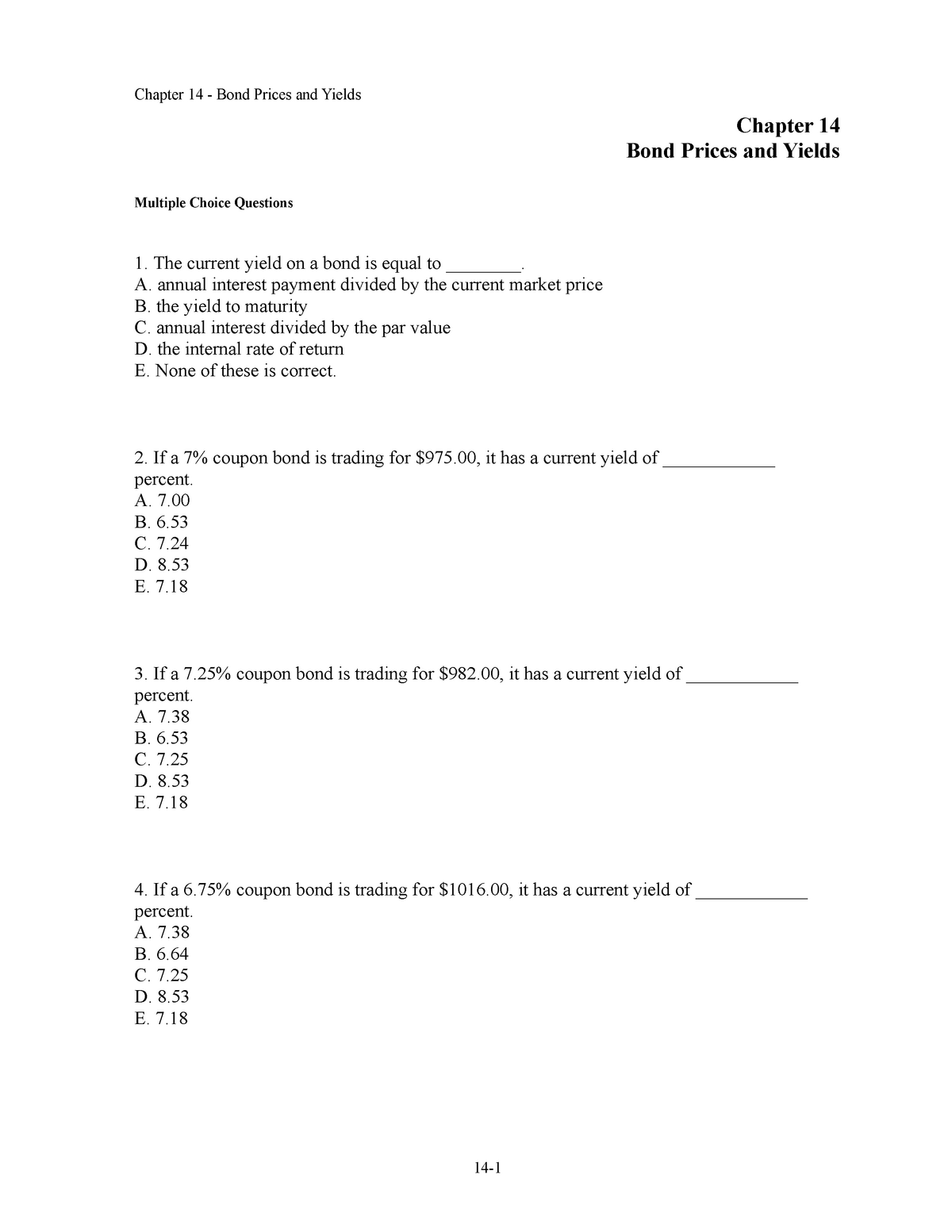

Coupon Rate Vs Current Yield Vs Yield To Maturity Ytm Explained With ... The yield to maturity (ytm) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. coupon vs. yield infographic let's see the top differences between coupon vs. yield. Ppt Interest Rates And Bond Valuation Powerpoint Presentation Id 242353 Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ... Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

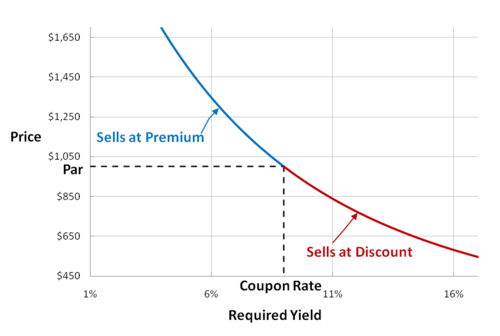

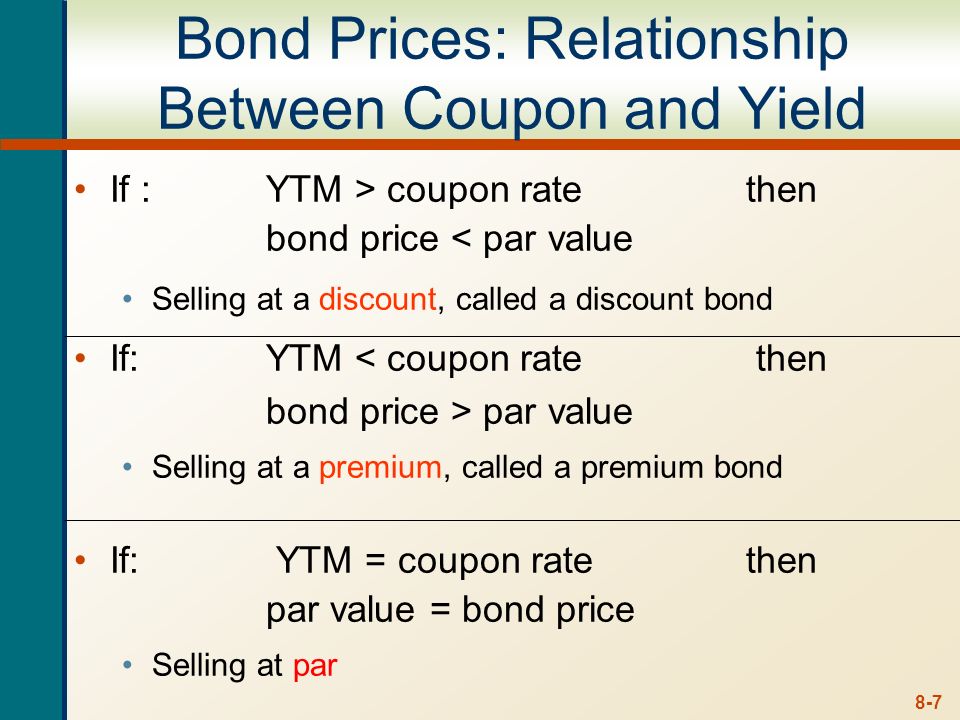

Coupon rate vs ytm. Yield To Maturity(YTM): Meaning & Coupon Rate Vs YTM Vs Current Yield ... Coupon Rate Vs YTM Vs Current Yield. Before we move further, let us understand that when you purchase a bond, there are three things that are fixed, given below with examples-1.Face Value- Rs 1000. 2.Coupon Rate- 8%. 3.Maturity Period- 5 years. Yields can be measured in multiple ways, out of which 3 most common measures are- Yield to Maturity vs. Yield to Call: The Difference Sep 16, 2022 · Yield to maturity is based on the coupon rate, face value, purchase price, and years until maturity, calculated as: Yield to maturity = {Coupon rate + (Face value – Purchase price/years until ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market? Coupon Rate Vs YTM - YouTube Learn more about the difference between a coupon rate and a yield to maturity.Investor's Business Daily has been helping people invest smarter results by pro... How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Yield to Maturity vs Coupon Rate: What's the Difference If you purchase the bond at face value, the YTM and the coupon rate are the same. Otherwise, the YTM increases or decreases depending on whether you've purchased a discount or premium bond. Compare the Yield to Maturity vs Coupon Rate Before Purchasing Bond. Investing your money is not an action you should take lightly.

Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,... Interest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : 9

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Rate vs Interest Rate | Top 8 Best Differences (with ... Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Yield to Maturity vs. Coupon Rate: What's the Difference? Coupon Rate vs Yield to Maturity The difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value . In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds.

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

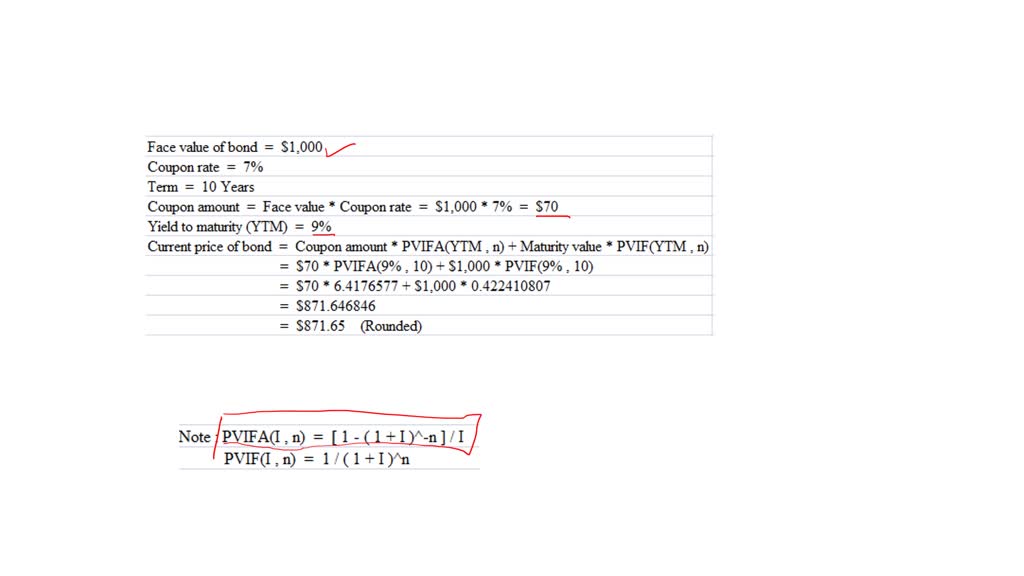

bond prices wms inc has 7 percent coupon bonds on the market that have 10 years left to maturity the bonds make annual payments if the ytm on these bonds is 9 percent what is the current bond price

Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ...

Coupon Rate Vs Current Yield Vs Yield To Maturity Ytm Explained With ... The yield to maturity (ytm) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. coupon vs. yield infographic let's see the top differences between coupon vs. yield. Ppt Interest Rates And Bond Valuation Powerpoint Presentation Id 242353

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 coupon rate vs ytm"