41 price of coupon bond

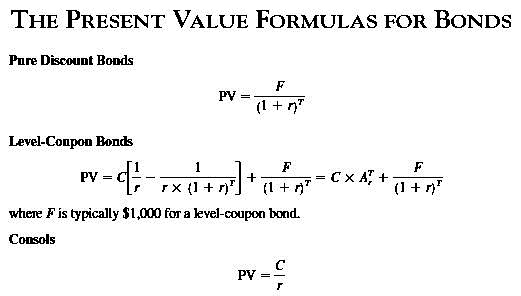

Answered: the following information to answer the… | bartleby the following information to answer the questions. Bond A Bond B Face Value 1000 1000 Coupon rate 10% 8% Coupons paid out Semi-annually Quarterly Years to maturity 4 4 Bond price 800 ? Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

Bond Coupon Interest Rate: How It Affects Price - Investopedia A $1,000 bond has a face value of $1,000. If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national...

Price of coupon bond

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation As mentioned earlier, you can calculate the bond price using the conventional formula. Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6)) Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

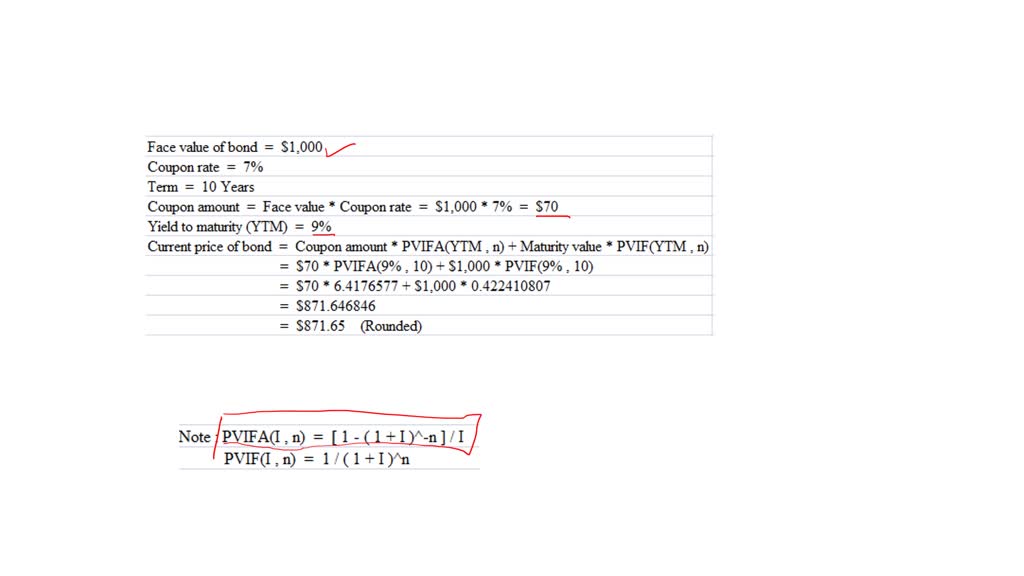

Price of coupon bond. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the impact of interest rate shifts. Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the SP 500 with ... Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM.

Understanding Bond Prices and Yields - Investopedia A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market. Although... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $50 * [1 - (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) 1*9 Coupon Bond = $932 Bond Pricing Formula | How to Calculate Bond Price? | Examples The price of the bond calculation using the above formula as, Bond price = $83,878.62 Since the coupon rate is lower than the YTM, the bond price is less than the face value, and as such, the bond is said to be traded at a discount. Example #2 Let us take an example of a bond with semi-annual coupon payments. Spandana Sphoorty Financial Limited - Bond Price, Yield Percentage ... A bond that pays a fixed coupon will see its price vary inversely with interest rates. This is because bond prices are intrinsically linked to the interest rate environment in which they trade for example - receiving a fixed interest rate, of say 8% is not very attractive if prevailing interest rates are 9% and become even less desirable if ...

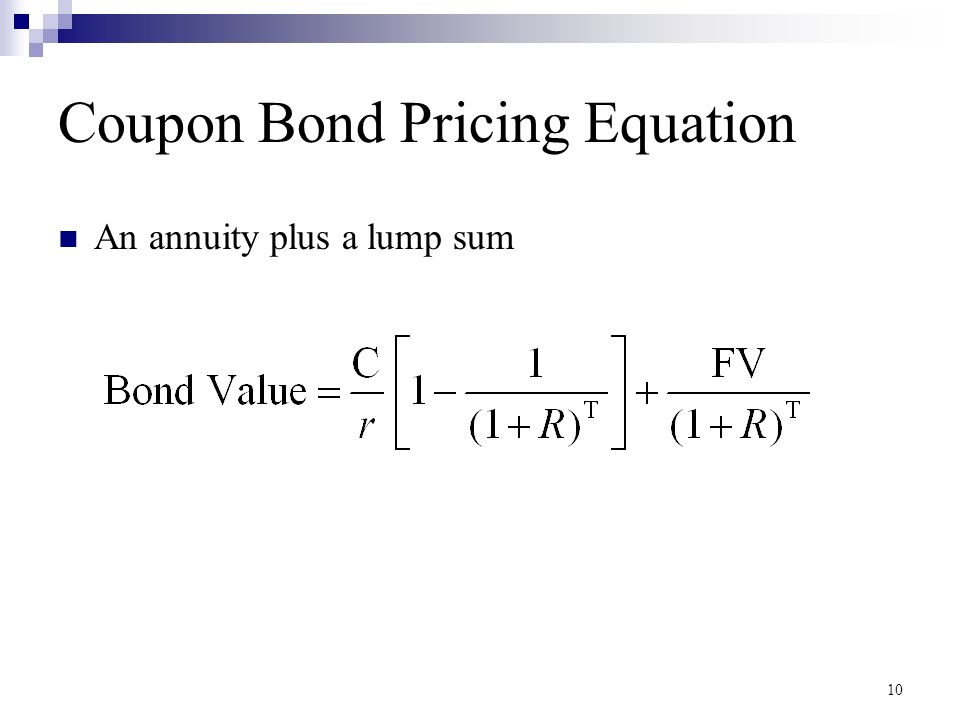

Bond Pricing - Formula, How to Calculate a Bond's Price The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … [ (PMT (Tn) + FV) / (1 + r)^n] Where: P (T0) = Price at Time 0 PMT (Tn) = Coupon Payment at Time N FV = Future Value, Par Value, Principal Value R = Yield to Maturity, Market Interest Rates N = Number of Periods Bond Pricing: Main Characteristics Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. Solved 1. Valuing Bonds What is the price of a 15-year, zero | Chegg.com 2. Valuing Bonds Microhard has issued a bond with the following characteristics: Par: $1, 000 Time to maturity: 30 years Coupon rate: 7 percent Semiannual payments Calculate the price of this bond if the YTM is: a. 7 percent b. 9 percent c. 5 percent 3. Bond Yields Watters Umbrella Corp. issued 15year bonds two years ago at a coupon rate of 7.8 ... Coupon Bond - Guide, Examples, How Coupon Bonds Work Despite the bond's relatively simple design, its pricing remains a crucial issue. If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

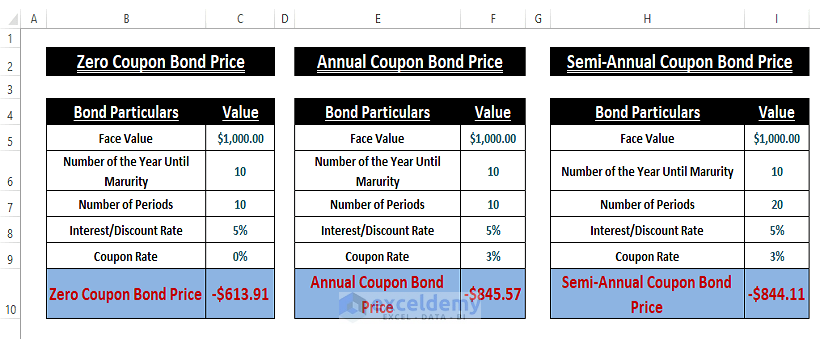

How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation As mentioned earlier, you can calculate the bond price using the conventional formula. Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6))

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

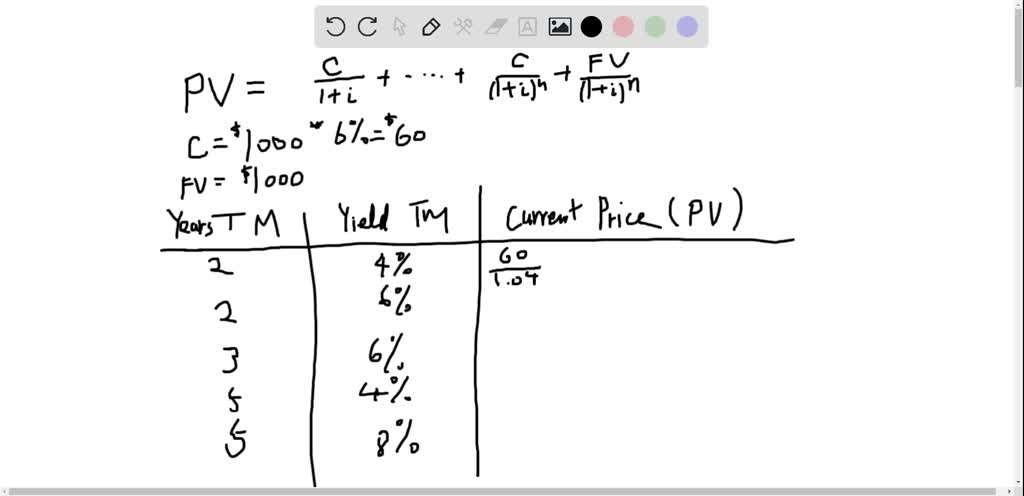

Consider a bond with a 6 % annual coupon and a face value of 1,000 . Complete the following table. What relationships do you observe between years to maturity, yield to maturity, and the current ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 price of coupon bond"