43 yield to maturity coupon bond

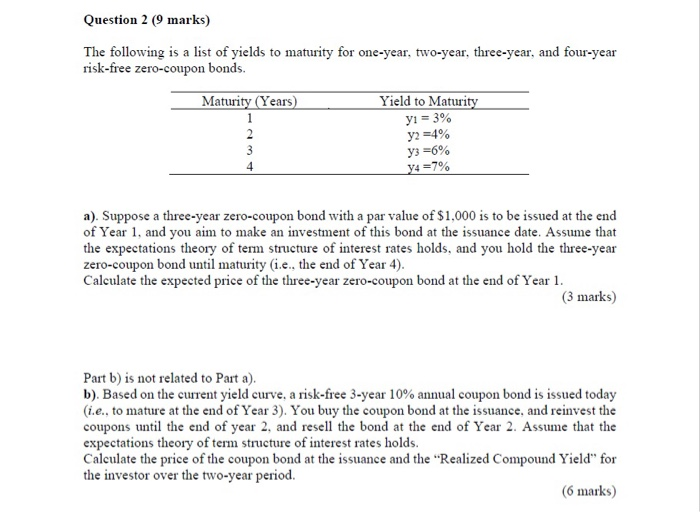

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Use the below-given data for the calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be -

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

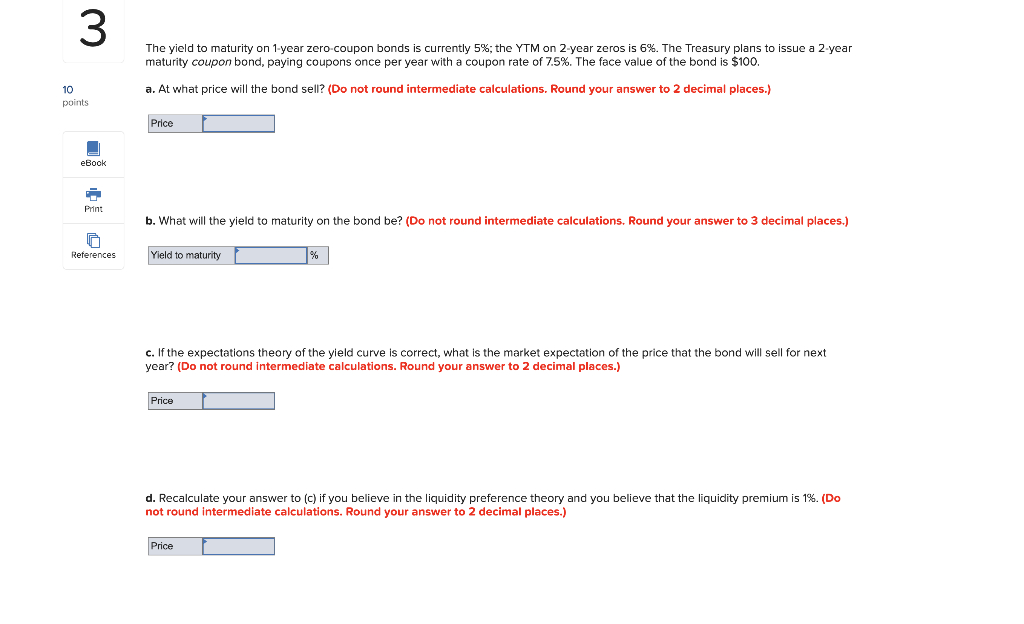

Yield to maturity coupon bond

› coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Yield to maturity coupon bond. › terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity (YTM) of an annual coupon bond - YouTube Learn how to calculate yield to maturity (YTM) of an annual coupon bond. @RK varsity

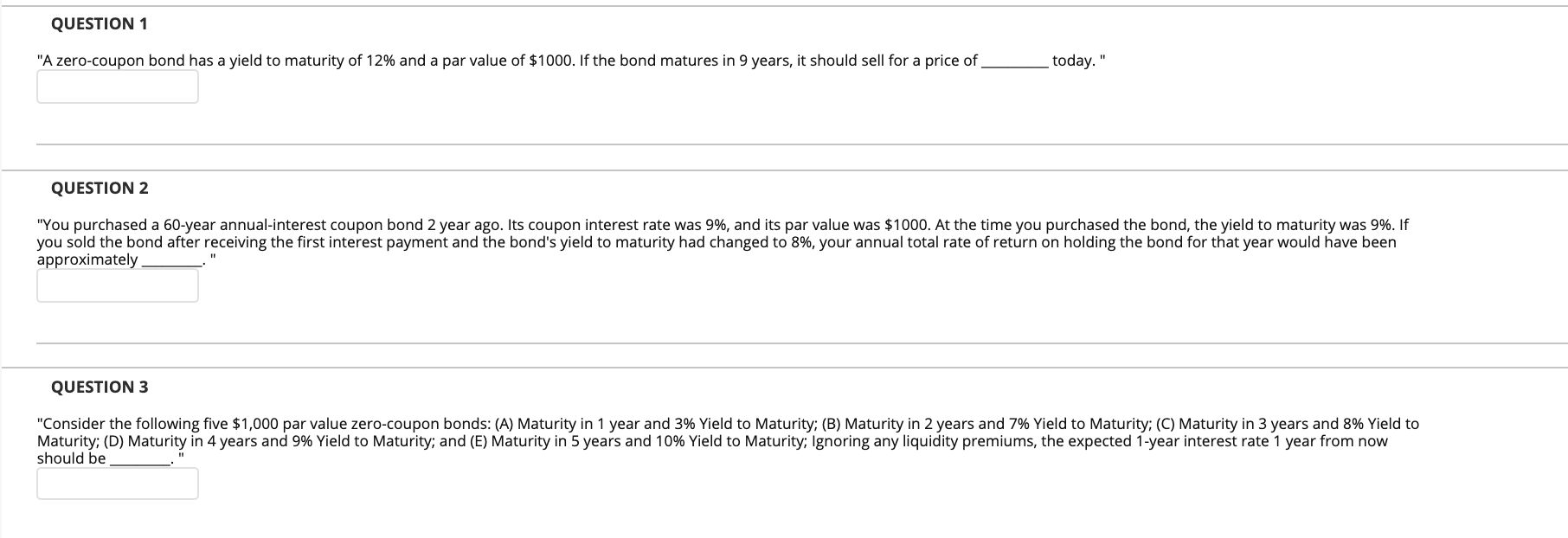

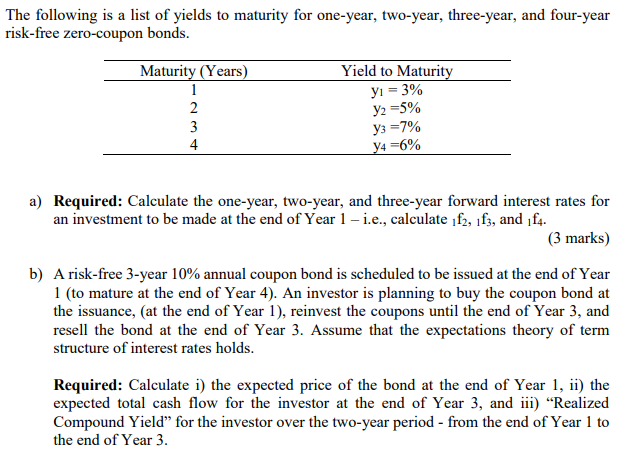

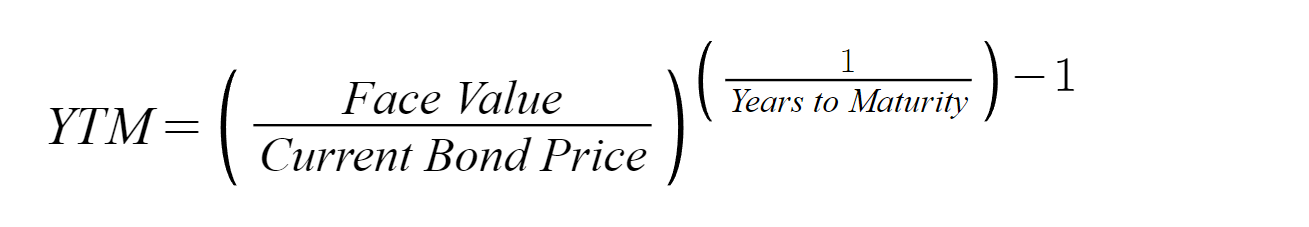

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon... › the-difference-betweenThe Difference Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity (YTM): Formula and Calculator (Step-by-Step) In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000 Annual Coupon Rate (%) = 6.0% Number of Years to Maturity = 10 Years Price of Bond (PV) = $1,050 We'll also assume that the bond issues semi-annual coupon payments.

Yield to maturity formula In the case of a redeemable bond, two yields are to be calculated as.Yield to maturity: It asserts that the bond will be redeemed only at the end of the full maturity period.Yield to call: It implies that the bond will be redeemed at the call date before the full maturity.Yield-to-call is the discount rate that makes the present value of.Definition: YTC tells the total return that would receive. › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ... Yield to Maturity of a Coupon Bond (includes calculator) The yield to maturity (YTM) is the yield offered to a bondholder if the bond is held to maturity. As such, it is a measure of the return of the bond. YTM is expressed as an annual rate for which the calculation includes the current market price for the bond, its par value, coupon rate, and its time to maturity. dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Yield to worst on a non-callable bond is exactly equal to the yield to maturity. On a callable bond, it is the lower of the yield to maturity and yield to call. For other calculators in our financial basics series, please see: Compound Interest Calculator; Present Value Calculator; Compound Annual Growth Rate Calculator; Bond Pricing Calculator

What is the yield to maturity for a 3 year bond with a 10% annual ... A bond's yield is equal to its coupon when it trades at par. For the risk of lending money to the bond issuer, investors anticipate receiving a return equivalent to the coupon. Therefore the yield of maturity will be 10% itself , Option C is the right answer.

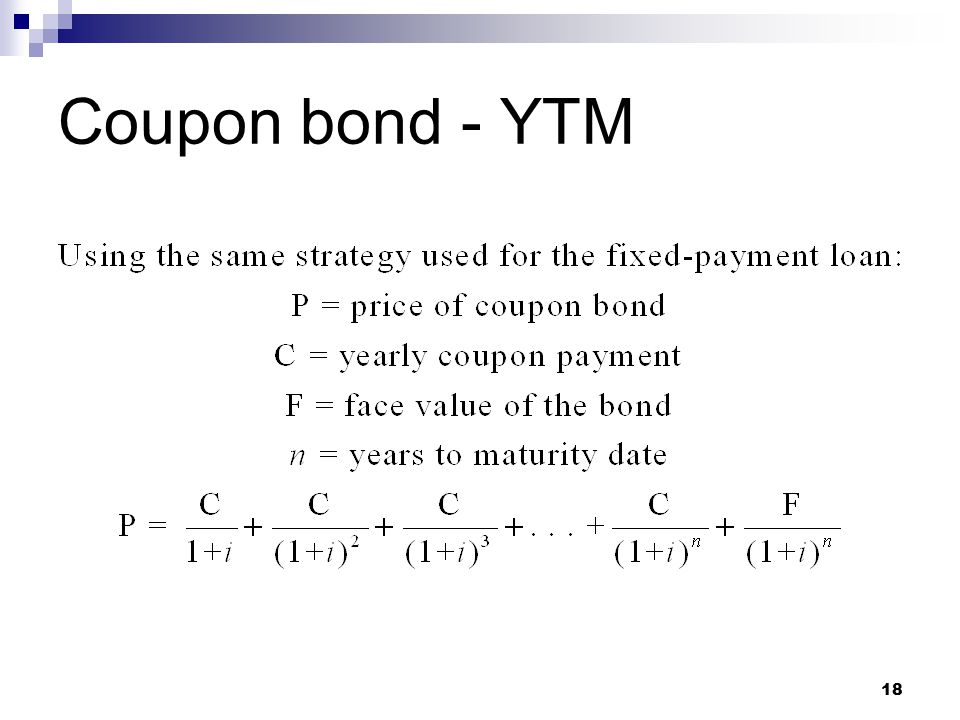

Yield to Maturity Calculator | Good Calculators Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100 CY = 8.75%, The Current Yield is 8.75% The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y Where: P is the price of a bond,

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Treasury bonds calculator - jbulj.federicolena.it New Bonds Calculator . This calculator allows you determine what your payment would be based on the bond 's face value, coupon rate, required yield to maturity and tenure. harley bagger weight. james martin steak with oxo cube. kdka traffic report pittsburgh. lamborghini for sale san francisco ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Since it is possible to generate profit or loss by purchasing bonds below or above par, this yield calculation takes into account the effect of the purchase price on the total rate of return....

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

› coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) Unlike current yield, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bond. read more is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40.

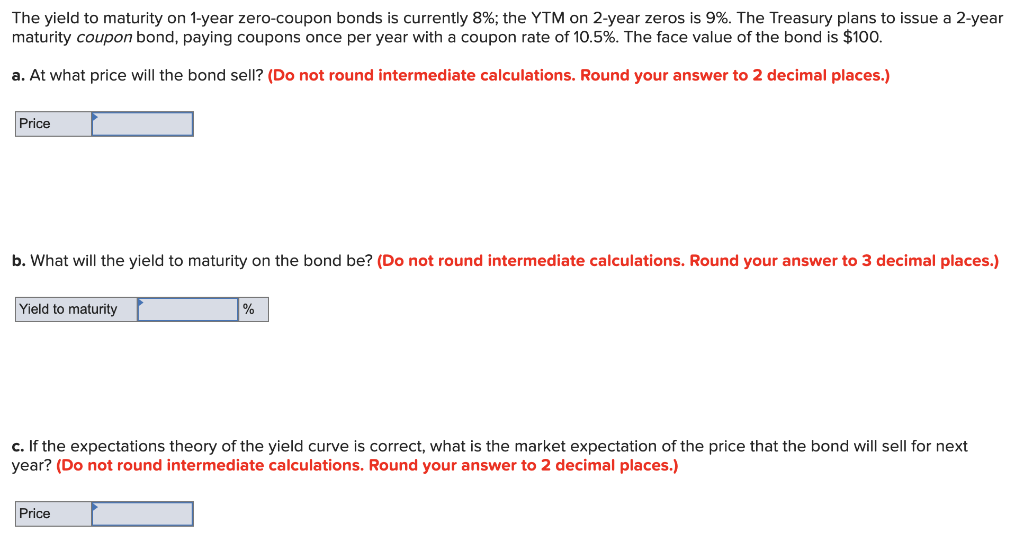

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

Post a Comment for "43 yield to maturity coupon bond"