39 duration of a coupon bond

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

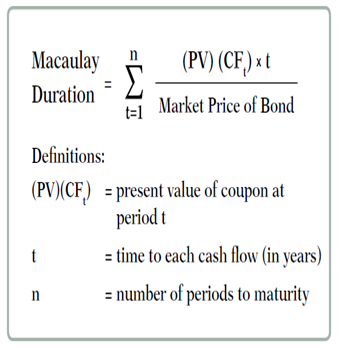

How to Calculate Bond Duration - wikiHow To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder).

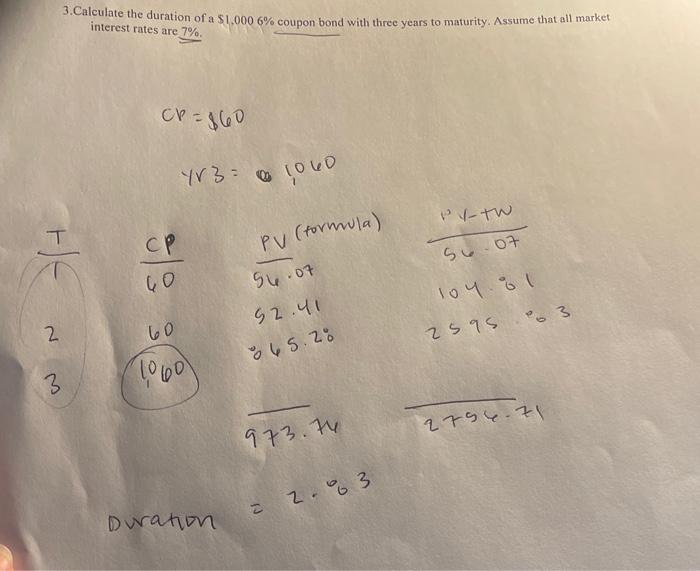

Duration of a coupon bond

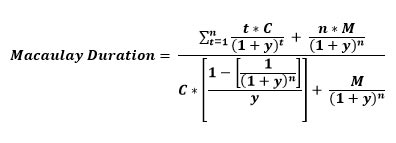

Dollar Duration - Overview, Bond Risks, and Formulas Dollar Duration. The change in the price of the bond for every 100 bps (basis points) of change in the interest rate. Written by CFI Team. Updated August 31, 2021. ... It means that as interest rates fall, bond coupon rates increase. Short-term bonds are less sensitive to interest changes, while a 20-year long-term bond may be more sensitive to ... › terms › dDuration Definition and Its Use in Fixed Income Investing Time to maturity and a bond's coupon rate are two factors that can affect a bond's duration. Macaulay duration estimates how many years it will take for an investor to be repaid the bond's price by... › duration-formulaDuration Formula (Definition, Excel Examples) | Calculate ... Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of ...

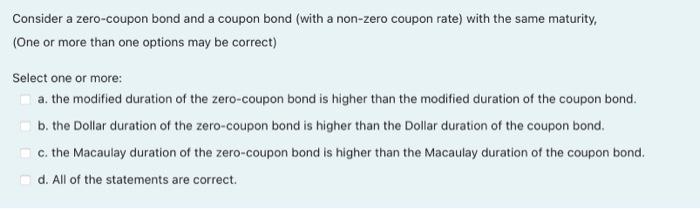

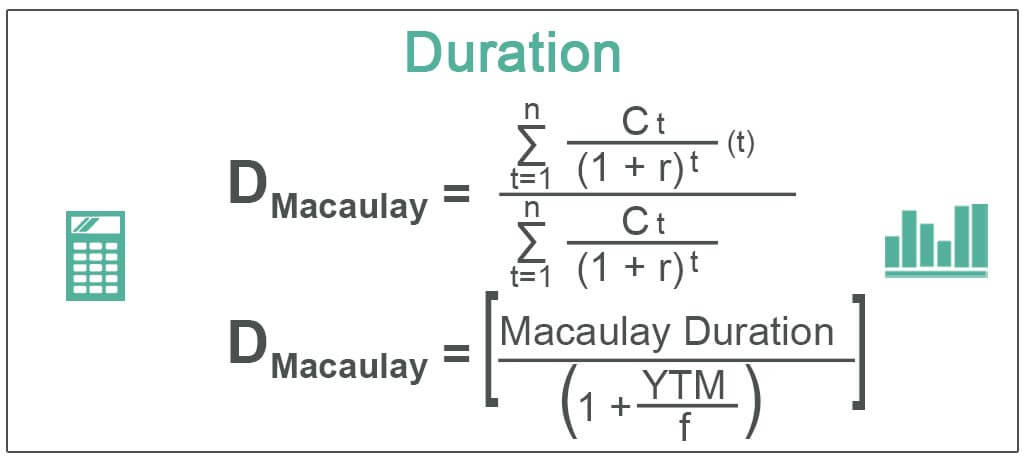

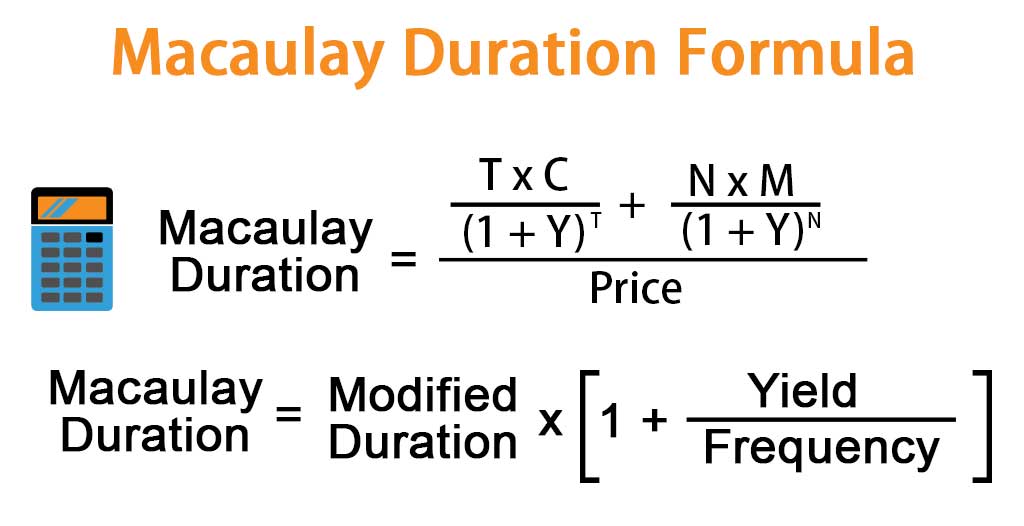

Duration of a coupon bond. Duration - Definition, Types (Macaulay, Modified, Effective) It is a measure of the time required for an investor to be repaid the bond's price by the bond's total cash flows. The Macaulay duration is measured in units of time (e.g., years). The Macaulay duration for coupon-paying bonds is always lower than the bond's time to maturity. For zero-coupon bonds, the duration equals the time to maturity. PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of How to Calculate the Bond Duration (example included) PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years What is the duration of a zero coupon bond? - Quora The duration of a zero coupon bond is equal to its maturity. Duration is a weighted average of the maturities of all the income streams of a bond or a portfolio of bonds. Therefore if there are coupons, the duration will be less than the maturity, and if there are no coupons it will be equal to its maturity. Pete Zeman

Duration and Convexity to Measure Bond Risk - Investopedia However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of... Duration Definition and Its Use in Fixed Income Investing - Investopedia Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. ... Ext Duration Treasury ETF." PIMCO. "PIMCO ... Understanding bond duration - Education | BlackRock Conversely, if a bond has a duration of five years and interest rates fall by 1%, the bond's price will increase by approximately 5%. Understanding duration is particularly important for those who are planning on selling their bonds prior to maturity. If you purchase a 10-year bond that yields 4% for $1,000, you will still receive $40 dollars ...

Understanding the Relationship Between Coupon Rates and Duration A high coupon rate bond provides more cash flow than a low coupon rate bond. Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures. Bond Duration Calculator – Macaulay and Modified Duration From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ... Duration | Definition & Examples | InvestingAnswers The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds - which have only one cash flow - have durations equal to their maturities. 2. Maturity. The longer a bond's maturity, the greater its duration and volatility. Duration changes every time a bond makes a coupon payment, shortening as the bond nears maturity. Bond Duration Calculator - Exploring Finance The bond duration calculator can be used to calculate the bond duration. Example is included to demonstrate how to use the calculator. ... Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years; t 2 = 1 years; t 3 = 1.5 years;

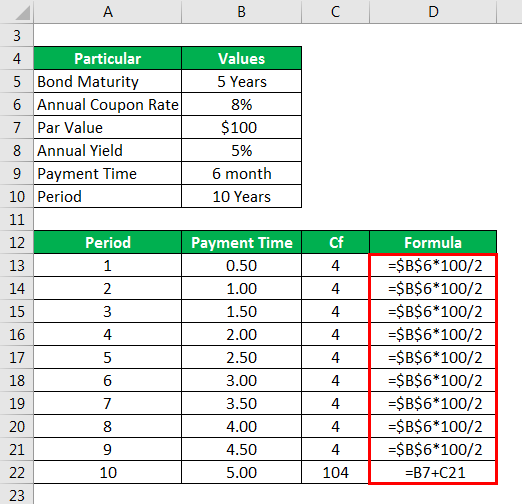

Duration Formula (Definition, Excel Examples) | Calculate Duration of Bond Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) …

Duration Part 1: Duration and Coupon | Chegg.com Part 1: Duration and Coupon Interest. Consider a five-year $1,000 face value, Treasury bond with a 10 percent yield to maturity selling at par. Calculate the duration if the semiannual coupon is 7% (5 Points) Calculate the duration if the semiannual coupon is 13% (5 Points) Calculate the duration if the semiannual coupon is 16% (5 Points) Plot ...

Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes.

What is the duration of a bond? and How to Calculate It? The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as yield, coupon rate, maturity, etc.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

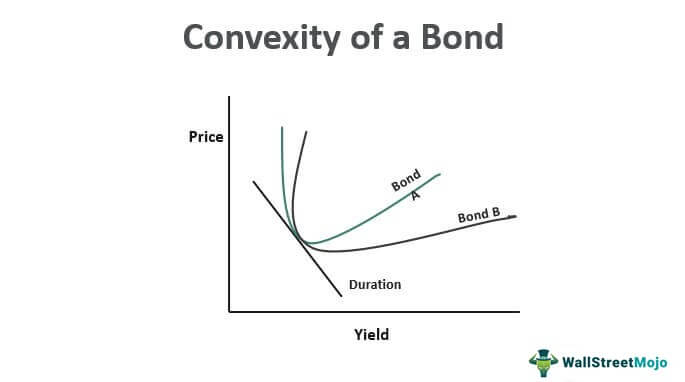

› convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation For a Bond of Face Value USD1,000 with a semi-annual coupon of 8.0% and a yield of 10% and 6 years to maturity and a present price of 911.37, the duration is 4.82 years, the modified duration is 4.59, and the calculation for Convexity would be:

dqydj.com › bond-duration-calculatorBond Duration Calculator – Macaulay and Modified Duration Coupon Payment Frequency - How often the bond pays interest per year. Calculator Outputs Yield to Maturity (%): The yield until the bond matures, as computed by the tool. See the yield to maturity calculator for more details. Macaulay Duration (Years) - The weighted average time (in years) for the bond's cash flows to pay out.

› duration-bondWhat is the duration of a bond? and How to Calculate It? The duration of a bond does not represent the duration for which an investor holds a bond. Instead, it refers to the relationship between the price of a bond and interest rates of the bond after considering its different characteristics such as yield, coupon rate, maturity, etc.

Bond duration - Wikipedia For example, a standard ten-year coupon bond will have a Macaulay duration of somewhat but not dramatically less than 10 years and from this, we can infer that the modified duration (price sensitivity) will also be somewhat but not dramatically less than 10%.

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually (1) What is the bond’s Macaulay Duration? (2) What is the bond’s Modified Duration? You can easily calculate the bond duration using the Bond Duration Calculator. Simply enter the following values in the calculator:

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Convexity of a Bond | Formula | Duration | Calculation The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high; While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

› duration-formulaDuration Formula (Definition, Excel Examples) | Calculate ... Duration = 63 years; The calculation for Coupon Rate of 4%. Coupon payment = 4% * $100,000 = $4,000. The denominator or the price of the bond Price Of The Bond The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of ...

› terms › dDuration Definition and Its Use in Fixed Income Investing Time to maturity and a bond's coupon rate are two factors that can affect a bond's duration. Macaulay duration estimates how many years it will take for an investor to be repaid the bond's price by...

Dollar Duration - Overview, Bond Risks, and Formulas Dollar Duration. The change in the price of the bond for every 100 bps (basis points) of change in the interest rate. Written by CFI Team. Updated August 31, 2021. ... It means that as interest rates fall, bond coupon rates increase. Short-term bonds are less sensitive to interest changes, while a 20-year long-term bond may be more sensitive to ...

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-02-a79edb63b9264dc9a76ee587240a27ea.jpg)

![Duration and Convexity [Concepts Series] | by Byrne Hobart ...](https://miro.medium.com/max/934/1*sId1I-O1GXScie24NpUXyQ.png)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "39 duration of a coupon bond"