41 what coupon rate should the company set on its new bonds if it wants them to sell at par

Answer in Finance for rim #9185 - Assignment Expert What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40 Multyiple choice | Business & Finance homework help - SweetStudy Suppose your company needs to raise $30 million and you want to issue 20-year bonds for this purpose. Assume the required return on your bond issue will be 7.5 percent, and you're evaluating two issue alternatives: a 7.5 percent semiannual coupon bond and a zero coupon bond. Your company's tax rate is 35 percent.

BDJ Co. wants to issue new 25-year bonds for some - SolutionInn BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 7.8 percent coupon bonds on the market that sell for $1,125, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Coupon.

What coupon rate should the company set on its new bonds if it wants them to sell at par

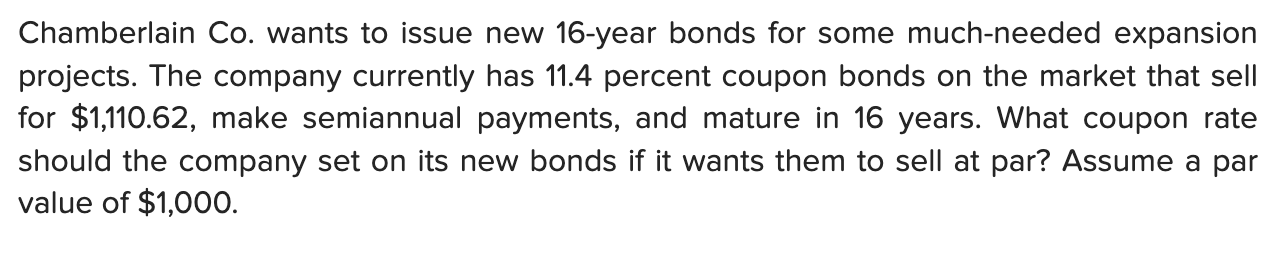

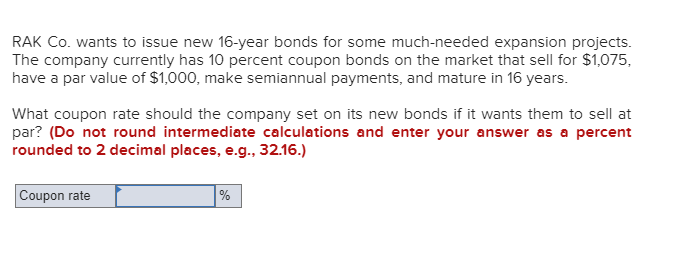

Answered: Chamberlain Co. wants to issue new… | bartleby A: Assuming Face value of bond = 100 Price of bond = 100 = Par value Coupon = Coupon Rate / 2 × Par… Q: The henderson company's bonds currently sells for $1375. They pay a $120 annual coupon and have a… 11 chamberlain co wants to issue new 18 year bonds - Course Hero View full document. 11.Chamberlain Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 10 percent coupon bonds on the market that sell for $1,075, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Finance 300 Exam 2 Flashcards - Quizlet Heginbotham Corp. issued 15-year bonds two years ago at a coupon rate of 7.9 percent. The bonds make semiannual payments. If these bonds currently sell for 109 percent of par value, what is the YTM? N = 26 I/Y = ? PV = 1090 PMT = 79/2 FV = 1000 I/Y = 3.422 You find a zero coupon bond with a par value of $10,000 and 19 years to maturity.

What coupon rate should the company set on its new bonds if it wants them to sell at par. BDJ Co. - Coupon Rate Bonds - brainmass.com BDJ Co. wants to issue new 10-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Finance Midterm 1 Flashcards - Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Seether co wants to issue new 20 year bonds for some - Course Hero What coupon rate should the company set on its new bonds if it wants them to sell at par? →8.75% 4.38% 8.65% 8.85% 8.00% The company should set the coupon rate on its new bonds equal to the required return. The required return can be observed in the market by finding the YTM on outstanding bonds of the company. (Get Answer) - PQR Co. wants to issue new 10-year bonds for some much ... PQR Co. wants to issue new 10-year bonds for some much-needed expansion projects. The company currently has 5.8 percent coupon bonds on the market that sell for $1,125, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. 7.3.docx - 1. Coccia Co. wants to issue new 20-year bonds ... - Course Hero Coccia Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,075, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Round your answer to 2 decimal places. Solved Chamberlain Co. wants to issue new 16-year bonds for - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? Question: Chamberlain Co. wants to issue new 16-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,035, make semiannual payments, and mature in 16 years. TBUS350 BUSINESS FINANCE CH 6 Flashcards - Quizlet What is the coupon rate: (70.22/1000)= 7.022% National and Real Returns. An investment offers a total return of 14% over the coming year. Bill Bernanke thinks the total real return on this investment will be only 10%. What does Bill believe the inflation rate will be over the next year?

BDJ Co. wants to issue new 25-year bonds for some much-needed expansion ... BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have a $1,000 par value, and mature in 25 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Advertisement BDJ Co. wants to issue new 18-year bonds for some much-needed expansion ... The company currently has 9.9 percent coupon bonds on the market that sell for $1,139, make semiannual payments, have a par value of $1,000, and mature in 18 years. Required: What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not include the percent sign (%). What Are Corporate Bonds? What You Need To Know | GOBankingRates The interest rate, sometimes called the coupon rate, tells you how much interest you will earn on the bond. Interest on corporate bonds is usually paid twice per year, but the interest rate is expressed in annual terms. If you purchase a bond with a par value of $1,000 and a coupon rate of 10%, you will get $100 in interest each year, in two ... Coupon Rate the Company Should Set on Its New Bonds A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at.

Answered: 22. Bond Yields [LO2] Chamberlain Co.… | bartleby Transcribed Image Text: 22. Bond Yields [LO2] Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years.

Ashok Co. wants to issue new 19-year bonds for some necessary expansion ... The company currently has 8.2% coupon bonds on the market that sell for $1,148.09, make semiannual payments, and mature in 19 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1,000. 2 See answers Advertisement tallinn The coupon rate would be is = 6.8%

Post a Comment for "41 what coupon rate should the company set on its new bonds if it wants them to sell at par"